Litecoin’s comeback has been in the headlines for a while now. Throughout the past week, the altcoin has seen immense growth. According to on-chain statistics, Litecoin’s weekly volume has reached its highest level since May 2023. This demonstrates the sudden increase in the LTC network, which is considered to be a bullish indicator.

Also Read: Ripple Price Prediction For November 2024: How High Will XRP Go?

Litecoin’s Rising Volume

Jay Milla, the director of marketing at Litecoin Foundation, brought the latest development to light through a post on X. He pointed out that the LTC network has had significant transactions during the last week. Here, “transaction volume” refers to an on-chain measure that records the total quantity of Litecoin involved in daily network transactions.

The network has witnessed transactions totaling 512.8 million LTC in the last week alone, which is over $35.4 billion at the current cryptocurrency exchange rate. This indicates that the chain has been seeing average daily volumes of more than $5 billion.

With the recent increase in the volume of Litecoin transactions, users have been engaging in more activity. According to the network activity, Litecoin has historically performed well because of its reputation for quick and inexpensive transactions. This feature seems to be able to garner user attention even now.

Also Read: Apple (AAPL) Stock Plummets: iPhone 16 Orders Slashed by 10M Units

Is This The Altcoin’s Ticket To The Top 10?

Litecoin was once a top cryptocurrency, one of the earliest assets in the market. LTC is currently the 21st largest cryptocurrency in the market. The asset has a market cap of $5.24 billion, following a 1.23% over the past 24 hours. Considering the other cryptocurrencies in the market, LTC’s surge to the top 10 will be challenging.

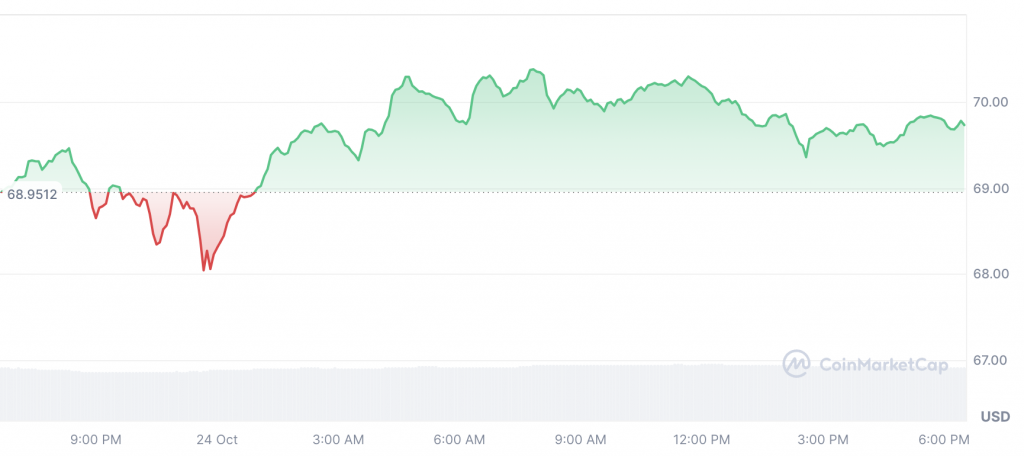

Litecoin was trading at $69.74 at press time following a 1.21% rise over the last 24 hours. It should be noted that LTC surged over $75 earlier this week.

Also Read: Cryptocurrency: Top 3 Coins That May Hit All Time Highs In November