Amid what has been a down period for the tech company, Intel (INTC) is reportedly eyeing the sale of its Altera business at a $17 billion valuation. The move has given the company’s stock a slight boost, as it is looking to offload a minority stake in its programmable chipmaking sector.

Since it unveiled is Q2 earnings report, things have looked grim for Intel stock. Yet, there is a chance that an Altera sale could begin to get things back on track for the firm. An outside investment could give the company an interesting nudge upward with October 31st Q3 earnings on the horizon.

Source: Business Insider

Also Read: Intel: 4 Reasons Why You Should be Worried About INTC

Intel Selling Minority Stake in Altera as INTC Shows Investor Optimism

One of the biggest technology developers in the United States is looking to make a big change. Indeed, CNBC reported that Intel is looking to sell its Altera business at a $17 billion valuation. The move would be a massive game changer for the company, at least that’s what they would hope.

After some underwhelming performances, the report had INTC stocks rising noticeably on Friday. Interestingly, the sale has a few different outcomes, according to sources. Although Intel is looking for minority investors, they have not ruled out finding a majority acquirer for the subsidiary.

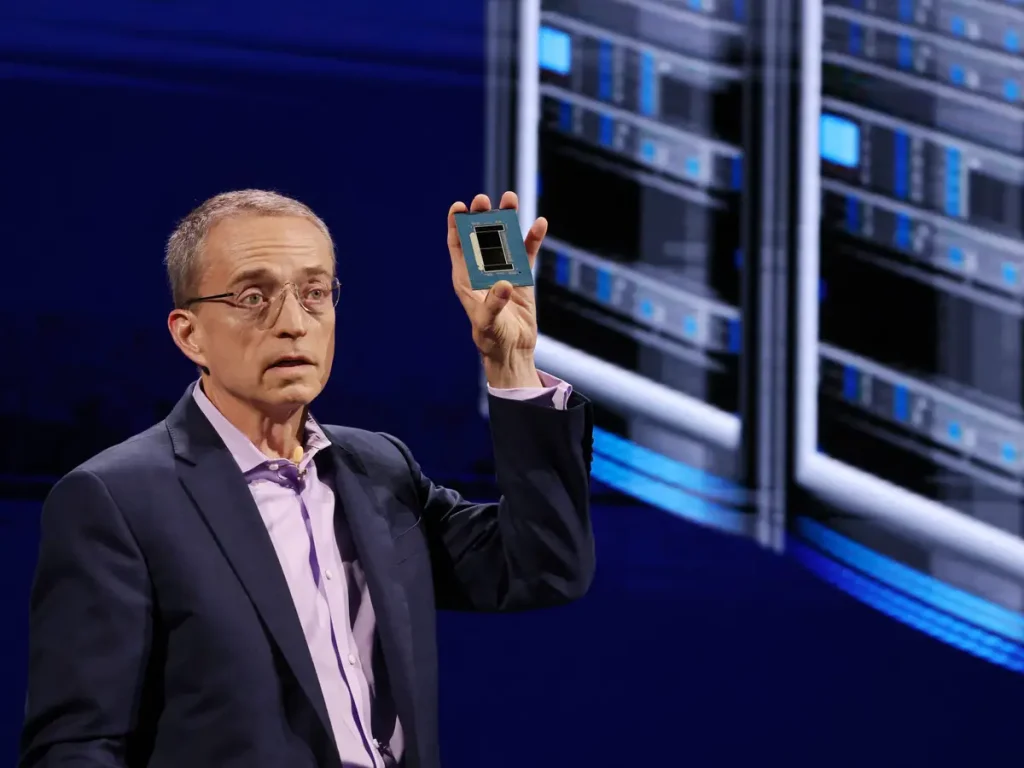

Credit: Intel Corporation

Also Read: Intel: INTC Eyes Halloween Turnaround as Key Report Looms

Intel had purchased Altera nine years ago for $16.7 billion. Moreover, the move to sell minority shares in the company is connected to Intel’s desire to “make drastic changes.” A significant fall in INTC price, as well as market share losses extending for the last couple of years, have shown those dire changes are a necessity for the company.

Intel has not yet commented on the rumblings. However, such a move would be a massive shift. Just last month, CEO Pat Gelsinger spoke of Altera as a core part of the company’s future. That would indicate that the company is looking for minority investors. However, it will be interesting to see how companies approach the sale. Moreover, how they value the business amid Intel’s current woes.