Your guide: Does Spectrum Let you Take Out of 401K?

A major component of financial health is retirement planning hence 401(k) plans have become a common tool for workers to invest for their golden years. Being a top provider of telecoms, Spectrum gives staff members access to a 401(k). Still unresolved, though, is whether Spectrum lets its staff members leave their 401(k) accounts.

The nuances of Spectrum’s 401(k) plan—including the laws and regulations regarding withdrawals, the several ways in which employees could access their retirement assets, and the possible tax consequences of such activities—will be covered below.

So, if you’ve ever wondered, “Does Spectrum Let you Take Out of 401K?” you’ve come to the right place. Keep reading to find out more.

Also read: BRICS Currency Threatens US Dollar Dominance in Oil & Global Banking

Knowing Spectrum’s 401(k) Strategy

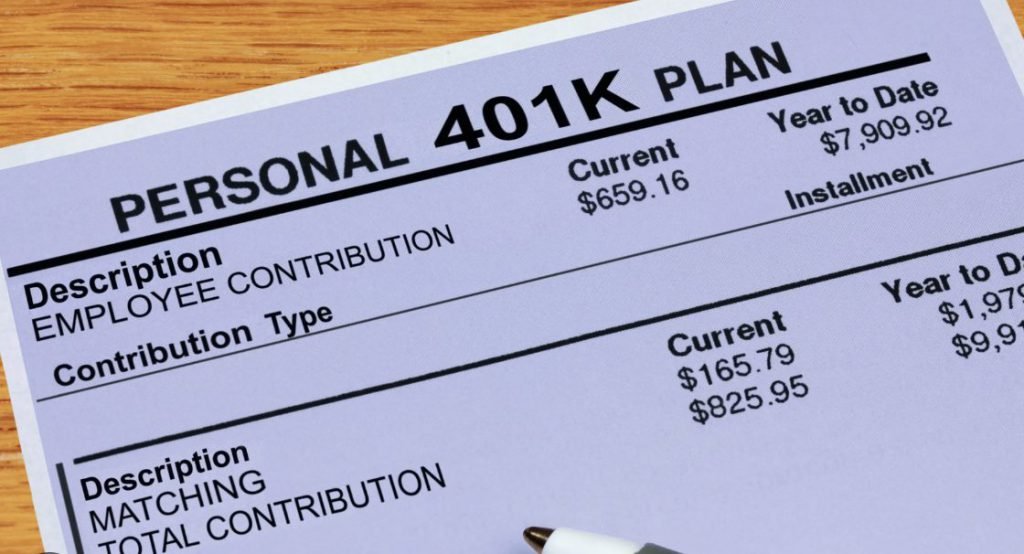

Like many companies, Spectrum provides a 401(k) program to help staff members save for retirement. Under this strategy, employees can finance a separate retirement account with some of their pre-tax or post-tax (Roth) income. This then grows tax-deferred until the money is withdrawn.

The Internal Revenue Service (IRS) sets and yearly adjusts the maximum annual contribution limit for a 401(k) plan for inflation. The cap is $23,000 in 2024; individuals 50 years of age and above will have an additional $7,500 catch-up contribution.

Further increasing an employee’s retirement savings might be Spectrum’s employer contributions—such as matching or profit-sharing. They typically follow what’s called a vesting schedule. These employer contributions mean the employee must work for the company for a certain amount of years. Once they meet this time, they can gain complete entitlement to the money.

Does Spectrum Let You Take Out of 401K?

A set of guidelines by the Employee Retirement Income Security Act (ERISA) and the IRS controls one’s capacity to withdraw from a 401(k). Although Spectrum’s proposal might include certain particular clauses, there are usually just a few situations whereby an employee may access their 401(k) money:

Retired or Divided from Service

Usually eligible to withdraw their 401(k) assets without paying a 10% early withdrawal penalty, an employee reaches the age of 59 1/2 or leaves Spectrum’s employment. These payouts follow the normal regular income classification.

Hardship Withdrawals

Under financial difficulty—that is, medical bills—an employee may withdraw some of their 401(k) money either to pay for higher education or to avert eviction or foreclosure. These hardship withdrawals, however, come under tight restrictions and can be liable for taxes and penalties.

Debt

Some 401(k) plans, like Spectrum’s, might let users borrow a fraction of their account balance—usually up to 50% of the vested account value or $50,000, whichever is less. These loans have to be paid back in five years, and the interest paid back into the employee’s 401(k) account.

Required Minimum Distributions (RMDs)

Once an employee becomes 73 (or 72 if they turned 72 before 2023), they typically have to start making minimum distributions from their 401(k) plan. Subject to income taxes, these RMDs are made from the account balance and the employee’s life expectancy.

Note that the particular guidelines and policies controlling 401(k) withdrawals may differ depending on the plan administrator or employer. Workers need to carefully review the summary plan description of their Spectrum 401(k) plan or consult a financial counselor to better understand their options. Typically, there might be potential tax consequences for any withdrawals.

Taxes Regarding Spectrum 401(k) Withdrawals

While the tax status of 401(k) withdrawals can be complicated, Spectrum staff members should be aware of the possible ramifications. Usually taxed as ordinary income, classic 401(k) plans mean the money is liable to federal and state income taxes.

If an employee has a Roth 401(k), though, contributions are made with after-tax money, and eligible distributions after age 59 1/2 are tax-free. The Roth 401(k) account has to have been open for five years to be eligible for this tax-free status.

Apart from the regular income tax, early withdrawals (before the age of 59 1/2) could also be liable to a 10% federal tax penalty, unless an exception exists, such as a hardship withdrawal or a withdrawal to pay medical bills.

To be sure they are making wise selections, Spectrum staff members must carefully analyze the tax consequences of any 401(k) withdrawals and speak with a tax advisor or the plan administrator.

Also read: BRICS: 40 Countries Want To Ditch the US Dollar

Rollovers and Portability

A 401(k) plan offers portability among other advantages. Without paying immediate taxes, an employee leaving Spectrum can roll over their 401(k) money into a new employer’s retirement plan or an individual retirement account (IRA).

Using this rollover process, the employee can keep their retirement funds in tax-deferred form and keep building their nest egg. To prevent any possible tax fines or issues, it is imperative to make sure the rollover is carried out properly nevertheless.

Regarding rollovers, spectrum personnel should also be aware of the guidelines around required minimum distributions (RMDs). Should an employee be obliged to take RMDs from their 401(k) plan and be 73 (or 72 if they turned 72 before 2023) they must do so before rolling over the money to a new plan or IRA.

Employment Matching and Vesting

To help their workers save for retirement, many companies—including Spectrum—offer matching contributions to their 401(k) plans. Though they are sometimes subject to a vesting period, these matching contributions can be a great complement to a retirement fund.

Vesting is the process by which a worker gains entitlement to their company’s contributions. Spectrum typically has a set vesting timeline, whereby full vesting takes place following a predetermined period of years.

Employees of Spectrum should be aware of how their plan’s vesting schedule can affect their access to the company’s contributions should they depart before fully vested.

Steering Clear of Penalties and Maximizing Retirement Savings

Employees trying to maximize their Spectrum 401(k) plan should try to prevent needless withdrawals and penalties. This involves giving much thought to the financial consequences of any 401(k) withdrawals and, should necessary, looking at other choices such as loans or hardship withdrawals.

Employees at Spectrum should also try to maximize their 401(k) plan contributions, up to the yearly contribution limit. If Spectrum makes a matching contribution, this can especially help since it essentially gives the employee’s retirement savings a “free” boost.

Understanding the guidelines around Spectrum’s 401(k) plan helps workers to make wise selections.

Conclusion: Does Spectrum Let You Take Out of 401K?

There you have it. If you’ve ever wondered, “Does Spectrum Let you Take Out of 401K?” now you know. Spectrum’s 401(k) plan is a great tool for workers saving for their retirement. But, it’s important to know the policies around them. Whether your consideration is a loan, a hardship withdrawal, or a rollover, you should carefully assess the possible tax consequences. Always speak with a financial or tax adviser.

Keeping educated and making calculated decisions regarding your Spectrum 401(k) plan can help you to make sure your retirement savings are on target and that you are fully utilizing the advantages this employer-sponsored retirement account has for you.