Billionaire conglomerate Mukesh Ambani’s Reliance Industries (RIL) shares have been in the news lately due to 1:1 stock splits. The company could announce a stock split in October, giving existing shareholders bonus stocks. The stock split could lower prices, giving ample buying opportunities for new investors.

Also Read: Jio Financial Services Stock Bounces Back: Time to Buy, Hold or Sell?

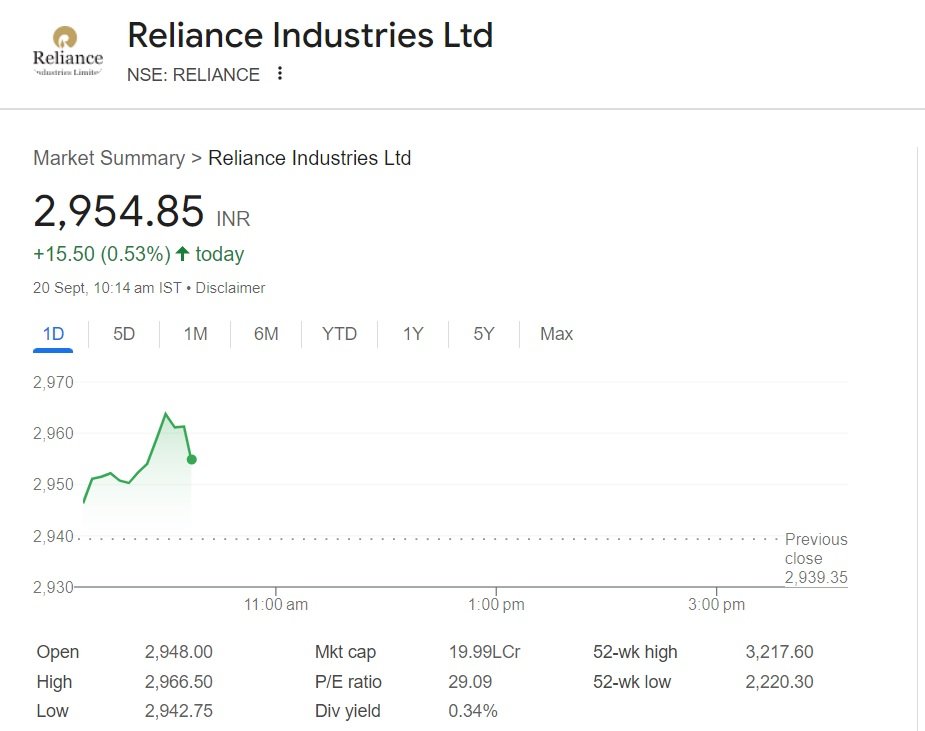

On Friday’s opening bell, Reliance Industries shares were trading at the Rs 2,954 level. RIL surged nearly 16 points in the day’s trade, rising 0.53% in the charts. The stock is attracting bullish sentiments after the board members’ decision to split 1:1.

Also Read: Another Analyst Urges To Sell IRFC Shares

Reliance Industries (RIL) Shares Could Reach Price Target of 3,435

Source: Jio RIL

Leading financial services company Motilal Oswal has added a ‘buy’ call for Reliance Industries shares. According to analysts from Motilal Oswal, RIL could reach a new target of Rs 3,435 on the heels of the stock split decision. That’s approximately a 16% surge in value from its current price. The buy call could ignite buying pressure on RIL, leading it to kick-start a rally.

Also Read: Nvidia Shares Could Reach $130 This Month

Reliance Industries’ critical revenues come from petrochemicals, oil, and gas. The demand for their products remains high in India and abroad, and the company earns billions of dollars per year. Just recently, RIL had also purchased oil from Russian tankers at discounted prices due to the sanctions.

India saved nearly $7 billion in exchange rates by paying for oil in local currencies with Russia. However, Reliance Industries has now paused procuring Russian oil and is buying from refiners in the US. Also, Reliance Industries is a large-cap share, and its movements can dictate the broader stock market index.

Sensex and Nifty could print new monthly highs if Reliance Industries shares rise 16% in the coming months. At press time, the Sensex is 84,155, and the Nifty is 25,702.