Blockchain company Sol Strategies has seen its stock price increase 420% in the past month following its decision to go all-in on Solana. The company, which rebranded from Cypherpunk Holdings in September, has transformed into one of SOL’s largest institutional holders.

Sol Strategies Shifts Focus to Solana Blockchain for Institutional Investors

Cypherpunk Holdings’ transition to Sol Strategies is a significant shift.

The Toronto-based company, once known for its broad crypto portfolio, has refocused its entire business model on the Solana blockchain.

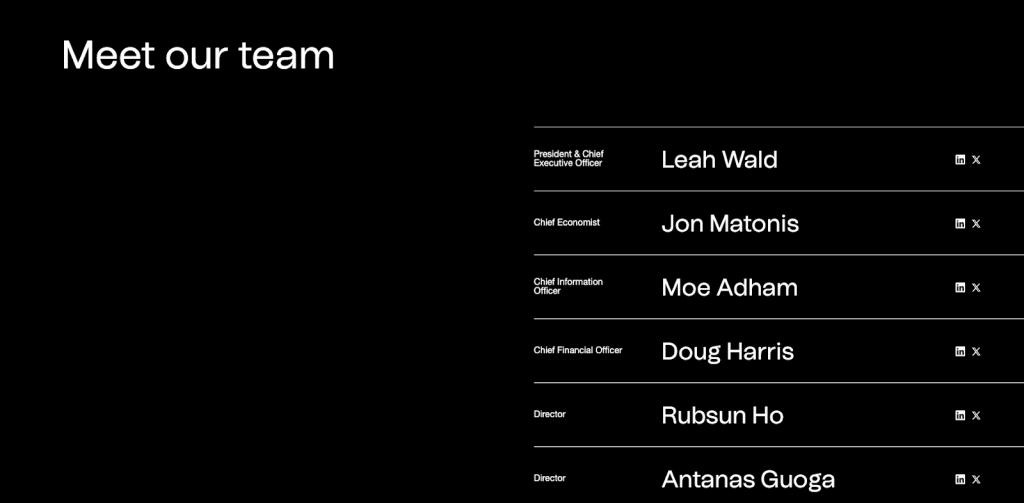

Under CEO Leah Wald’s leadership, the firm has quickly built up over 86,000 SOL and launched validator operations to support the network.

This combination of holding and staking sets Sol Strategies apart from most other crypto investment firms.

It positions the company as an active participant in the ecosystem – not just a passive investor.

As the first public company in North America to focus on Solana, Sol Strategies provides institutional investors with a regulated way to tap into this fast-growing blockchain.

It looks to parallel MicroStrategy’s approach.

MicroStrategy is famous for giving early Bitcoin exposure to Wall Street, and Sol Strategies aims to do the same for Solana.

HODL Stock Price Soars 420% as Solana-Centric Strategy Gains Momentum

Sol Strategies’ move into Solana has driven its stock price to new highs.

Trading under the ticker HODL on the Canadian Securities Exchange, the company’s shares have climbed to $0.98 – a 420% surge in the past month.

This surge has also boosted Sol Strategies’ market cap to CAD 143 million, marking a significant turnaround for investors who endured the lows of $0.095 in January.

The company’s momentum was further strengthened by securing a CAD 10 million revolving credit facility, giving it more resources to fuel its Solana-focused strategy.

This highlights the growing institutional interest in targeted crypto investments.

As the market begins to anticipate potential spot Solana ETF approvals, many expect Sol Strategies to continue capitalizing on this positive sentiment.

Investors are betting the company’s focus on Solana could position it well for the future.

Sol Strategies Boosts Revenue by Supporting Solana as an Active Validator

Beyond holding SOL, Sol Strategies actively supports the Solana blockchain as a network validator.

By running hardware to process and verify transactions, the company not only helps secure the network but also earns rewards for its efforts.

As of June 2024, these validation activities had generated around $57,000 in additional revenue.

Another reason for the increased HODL demand is the potential of Solana itself.

Solana’s key advantage is its ability to process thousands of transactions per second at a fraction of the cost of blockchains like Bitcoin and Ethereum.

These chains often face higher fees and slower speeds.

Naturally, Solana’s efficiency has caught the attention of both financial institutions and DApp developers.

For Sol Strategies, these technical benefits offer the potential for increased revenue as more users migrate to Solana.

Plus, Solana’s scalability could position it as a key platform for future financial applications.

In turn, that could boost demand for SOL.

Ultimately, Sol Strategies’ decision to rebrand and focus exclusively on Solana could be a strategic move that sets it up for long-term success.