The US government might sell $4 billion worth of Bitcoin soon. This has caused market speculation and comments from Peter Schiff, a well-known crypto critic. The potential sale comes from Bitcoin seized in the Silk Road case. It could greatly affect the cryptocurrency market.

Also Read: Crypto Scandal: Russia’s ‘Crypto Queen’ Caught with $70 Million in Suitcases

Peter Schiff’s Insights on the US Government’s $4B Bitcoin Sell-Off and Market Implications

The Silk Road Seizure

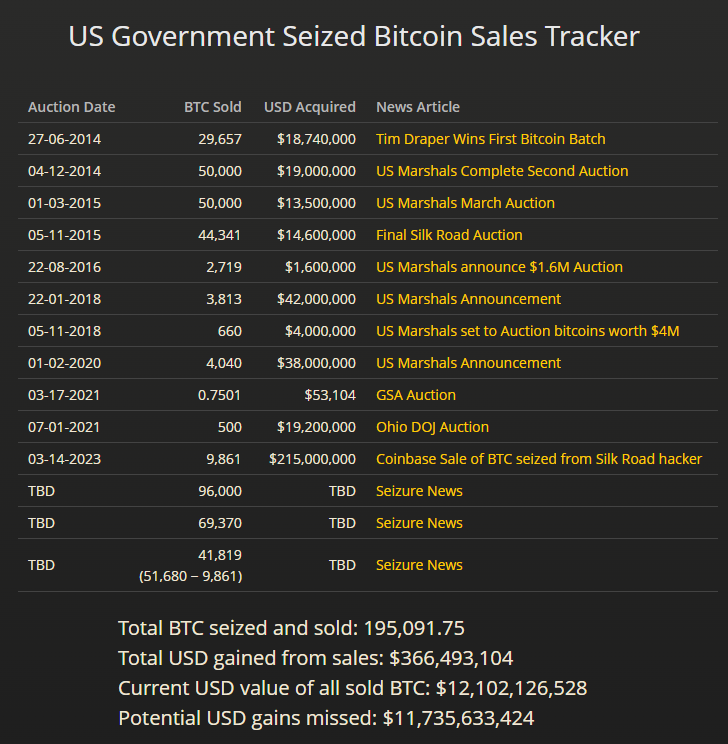

The US government now controls 69,370 Bitcoins taken from the Silk Road marketplace. These coins are worth about $4.38 billion at the time of writing. On October 7, the US Supreme Court gave the government full rights to these assets. Now, they can decide when and how to sell them.

Schiff’s Jab at Michael Saylor

Source: Cryptopolitan

Peter Schiff, who often criticizes Bitcoin, made a pointed comment about Michael Saylor of MicroStrategy.

Schiff said:

“I think Michael Saylor should have MSTR borrow another $4.3 billion and buy it. Who agrees with me?”

This shows the ongoing debate between Bitcoin critics and supporters. Saylor’s company owns over $15 billion in BTC.

Also Read: Here’s Why Bitcoin (BTC) Could Hit $100K in Q4

Market Impact and Election Considerations

When the US government sells its Bitcoin matters a lot. The 2024 US Presidential Elections are coming up. A big BTC sale could upset crypto-friendly voters. This might affect key states in the election.

Price Predictions and Buying Opportunities

Some experts think Bitcoin’s price could drop to $50,000 if the government sells a lot. But Adam Back, CEO of Blockstream, sees it differently. He thinks a government sell-off could be a good time for long-term investors to buy more BTC.

Also Read: Digital Yuan Gains Ground In Saudi-China Transactions Disregarding USD

Investors and market watchers are closely following the US government’s Bitcoin plans. The government’s decisions could shape BTC’s future and affect the whole cryptocurrency market.