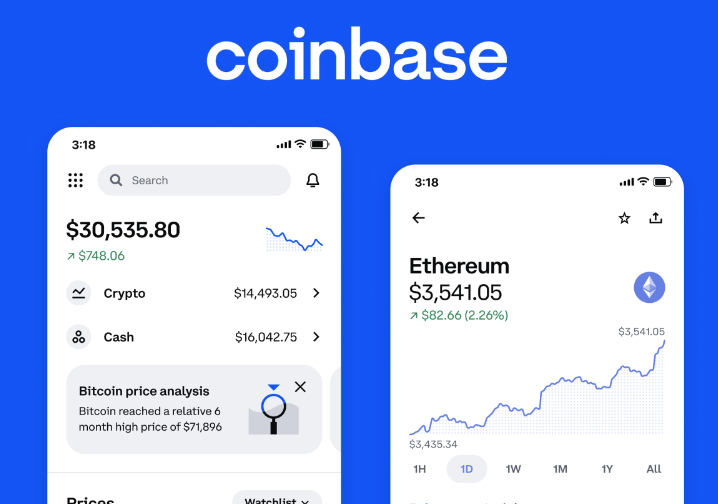

Your guide: What Bank is Coinbase on Plaid?

Coinbase is a renowned cryptocurrency trading platform that makes buying, selling, and managing digital assets easy. Coinbase now requires clients to connect their bank accounts via Plaid, a third-party financial data aggregator, which has raised concerns. This move is notable given Plaid’s recent privacy violation class action lawsuit.

As Coinbase users adjust to this transition, they must comprehend Plaid’s role in the exchange’s financial ecosystem. So, if you’ve wondered, “What Bank is Coinbase on Plaid?” you’re in luck. Today, we’ll cover this and more. Keep reading to find out more.

Also read: BRICS: Will Turkey Leave NATO for the Alliance in 2024?

Coinbase and Plaid Work Together

One of the biggest and most trusted coin exchanges, Coinbase, is known for having a simple interface and strong security. Coinbase now requires all of its customers to connect their bank accounts through Plaid, a financial technology company that makes connections between banks and apps safe.

Along with other efforts to speed up account verification and cash transfers, Coinbase added Plaid to its ecosystem. Coinbase wants to use Plaid’s better security and data collection to make banking easier and safer.

Knowing Plaid’s Role

Plaid is a fintech business that connects bank and credit card accounts to financial apps like Coinbase. Advanced encryption and security protect users’ sensitive financial data throughout data transit on the site.

Plaid’s connection lets Coinbase users securely connect their bank accounts for faster, more efficient fund transfers. This connection improves user experience by making it easy to transfer money between bank accounts and Coinbase wallets.

Concerns from Coinbase Users

Coinbase’s relationship with Plaid aims to improve user experience, but others have criticized it. Some Coinbase customers are concerned about the additional rule, especially after Plaid’s privacy violation class action lawsuit.

In July 2022, a federal court judge ordered Plaid to pay $58 million in a privacy class action settlement after consumers alleged the business gathered and sold their financial data without consent. Coinbase consumers are now worried about their financial data’s security and privacy.

Integrating Plaid

Plaid must be included in Coinbase despite user worries. Coinbase now requires customers to link their bank accounts through Plaid to continue using the platform.

Plaid requires your bank account username and password to connect. Plaid will securely authenticate your account and communicate with Coinbase for smooth fund transactions.

Plaid’s software acts as a mediator, protecting your sensitive financial data throughout the transfer. Using strong encryption and security mechanisms, Coinbase protects your data and transactions.

Potential Plaid Integration Benefits

Coinbase consumers are concerned about the Plaid integration, although it may have benefits.

User experience is a major benefit. Coinbase users may now move funds faster and more efficiently using Plaid’s technology, making trading easier. New user onboarding is simplified by the integration, which removes manual account verification.

Plaid’s sophisticated security and data protection protocols may also strengthen Coinbase’s financial environment. Coinbase may focus on its core skills by outsourcing account verification and data transfer to a fintech company, potentially boosting its reliability and trustworthiness.

Dealing with Privacy Issues

Coinbase customers are right to be worried about their privacy because of Plaid’s legal problems. Plaid’s job in the Coinbase environment is to act as a safe middleman, validating and sending financial information. It does not store or access this information.

Plaid says that strong encryption and security measures will keep private user data safe while it’s being sent. To deal with the class action case, the company has also tightened its data security and consent policies.

Coinbase also stresses the safety and privacy of its users. The exchange says it will keep its clients’ banking information safe, and adding Plaid will make the experience better for users without lowering security.

Coinbase’s Plaid Update Position

Coinbase has actively addressed customer concerns about the Plaid integration. The exchange says its partnership with Plaid is part of its continuous efforts to improve user experience and banking connectivity.

Coinbase said the Plaid integration is meant to improve the platform’s financial ecosystem without compromising user privacy and security. The transaction also guarantees that Plaid’s strong security mechanisms and encryption will safeguard consumers’ sensitive data.

Also read: BRICS To Create an Independent Payment System for Trade

Plaid’s Crypto-Native Products

Plaid has been extending its cryptocurrency presence while Coinbase’s Plaid integration is being discussed. The fintech startup introduced its first crypto-native solution, “Wallet Onboard,” for Web3 developers.

Wallet Onboard simplifies access to over 300 digital wallets, including MetaMask, Ledger, Coinbase Wallet, and TrustWallet. Plaid’s focus on Bitcoin and Web3 ecosystem solutions is evident in this move.

Conclusion

Coinbase users’ reactions to Plaid’s integration are varied.

Some folks mention that this change has made the user experience better. Plus, it also helps to increase security. In contrast, some other users feel as though it could be bad for privacy.

As they make changes, Coinbase users need to know Plaid’s role in the exchange’s financial environment and how both companies protect user data. Using Coinbase and Plaid’s communication channels and staying up to date can help users decide if they want to use the tool.

Coinbase’s ability to resolve customer concerns and deliver a secure, transparent platform that matches the cryptocurrency community’s increasing needs will determine the Plaid integration’s success.