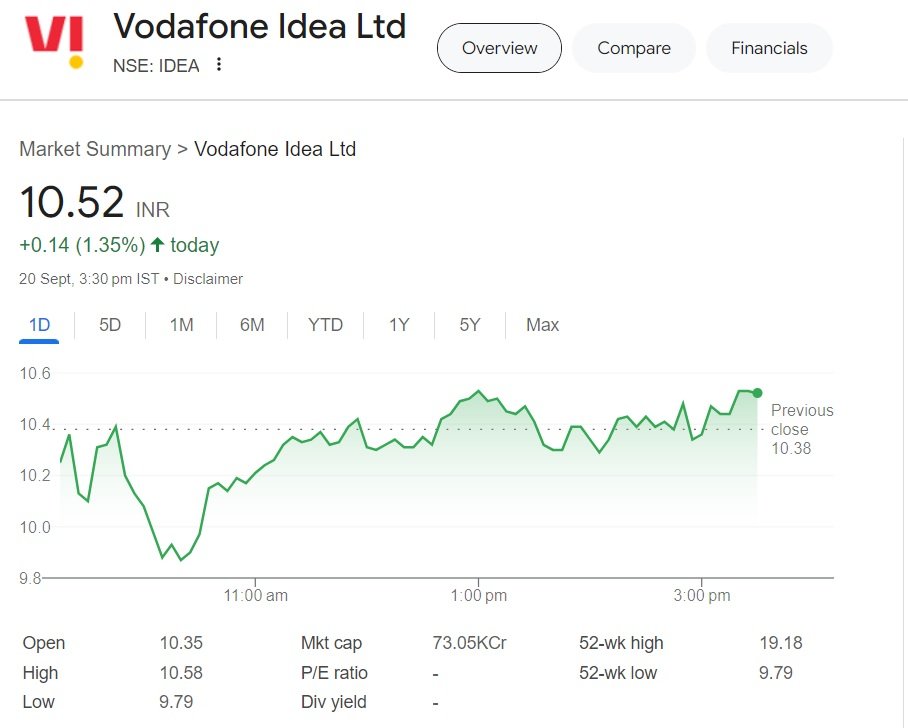

Vodafone Idea shares hit rock bottom at Rs 9.79 last week after plummeting 20% in the charts in a day. However, it closed Friday at 10.52 with a surge of 1.35% in the indices. It is now hovering around its 52-week low with investors fearful of taking an entry position in the stock.

Also Read: Don’t Buy Stocks Now, Warns Fundstrat’s Analyst

As fear has gripped Vodafone shares, leading financial institutional Nuvama has given a strong ‘buy’ call. When fear enters the market, greed needs to take center stage to make the most out of it.

Nuvama has predicted that Vodafone shares have bottomed out and could catapult in the charts next. The leading financial firm has predicted that Vodafone shares could Rs 15 in the medium to long term. That’s a surge of approximately 40% from its current price of 10.72.

Also Read: Jio Financial Services Stock Bounces Back: Time to Buy, Hold or Sell?

The financial firm remains bullish on Vodafone shares urging clients to buy low and sell high. However, since the stock dipped relentlessly, only a handful of traders and institutions could take an entry position. Retail investors might stay away from the stock as a few more dips from here could wipe away their portfolio.

Vodafone Shares In the Spotlight

Source: 123 RF

The shares of Vodafone will remain in the spotlight as the telecom firm will ink a mega-deal of $3.6 billion with Nokia, Samsung, and Ericsson. Vodafone will sign a partnership with the telecom giants to supply network equipment for the next three years. It will also launch the 5G network across the markets and look at expanding its reach.

Also Read: Another Analyst Urges To Sell IRFC Shares

“Nokia and Ericsson have been our partners since our inception and this marks another milestone in that continuing partnership. We are pleased to start our new partnership with Samsung. We look forward to work closely with all our partners as we move into the 5G era,” Akshaya Moondra, CEO of Vodafone Idea, said in an exchange filing.